Implementation of an IT tax system

Case study

I have decided to present this project in my portfolio due to the exceptional time, in which it was implemented. The beginning of the last decade of the 20th century was an exceptionally turbulent period, in which we experienced a political transformation, while digital technologies developed rapidly in the world. IBM PC personal computers with the MS-DOS system and monochrome monitors were increasingly found in offices and homes. Their heart and brain were 16-bit Intel 80286 processors, RAM with a capacity of about 4 MB and hard drives with a capacity of 40-80 MB. External data carriers were floppy disks with a capacity of 1.2 or 1.44 MB. Yes – it’s not a mistake – everything was counted in megabytes, not giga and terabytes …

The implementation of an IT system for real estate taxes, designed by Tadeusz Groszek from Info-System, was my first serious experience in an IT project. In addition to new technical and managerial skills, it has enriched me with valuable practice in the field of organizational change management. I conducted the project as part of the duties of the secretary of the city of Aleksandrów Łódzki, responsible for adapting the local government administration to the new political realities. Interdisciplinary education (technical and legal) helped me a lot. I was able to ensure effective communication between IT specialists and municipal officials. Ensuring mutual understanding between specialists from distant fields was essential to the success of this undertaking. It also made it possible to reduce emotions and the understandable fear of losing jobs.

Challenges

The introduction of information technology aroused great fears among the employees of the Finance Department. Some of them were convinced that they would not be able to learn how to use a computer, which was a completely unknown device for them. However, shortly after the system was launched, the employees of the office noticed the great facilitations offered by the new technology. Fears replaced joy and pride. It was the first or one of the first IT systems of this type implemented in the Łódź region.

The implementation of the software, based on the Novell NetWare network operating system, enforced the transparency of the accounting database and the transparency of information flow, which, however, was not satisfactory to all employees. Its launch was also associated with the need to digitally rewrite the extensive land register. On the one hand, it was a lot of extra work, and on the other, an opportunity to earn extra money.

Implementation of the IT system consists in carrying out two basic groups of activities: (1) adapting the system to the needs of the organization and (2) carrying out changes in the organization aimed at effective use of the possibilities offered by the IT system.

Maria Romanowska

The effects of implementing the IT system

Computer applications for tax assessment freed the employees of the Finance Department from the cumbersome manual work of quarterly tax calculation and manual writing of thousands of tax returns. Calculating taxes on the calculator was a tedious, tiring job with a high risk of error. With the introduction of computers, all you had to do was mark a range of property records. The computer and printer did the rest of the work. Since then, the work of mubicipal tax officials has mainly been to update real estate data and the relevant tax rates.

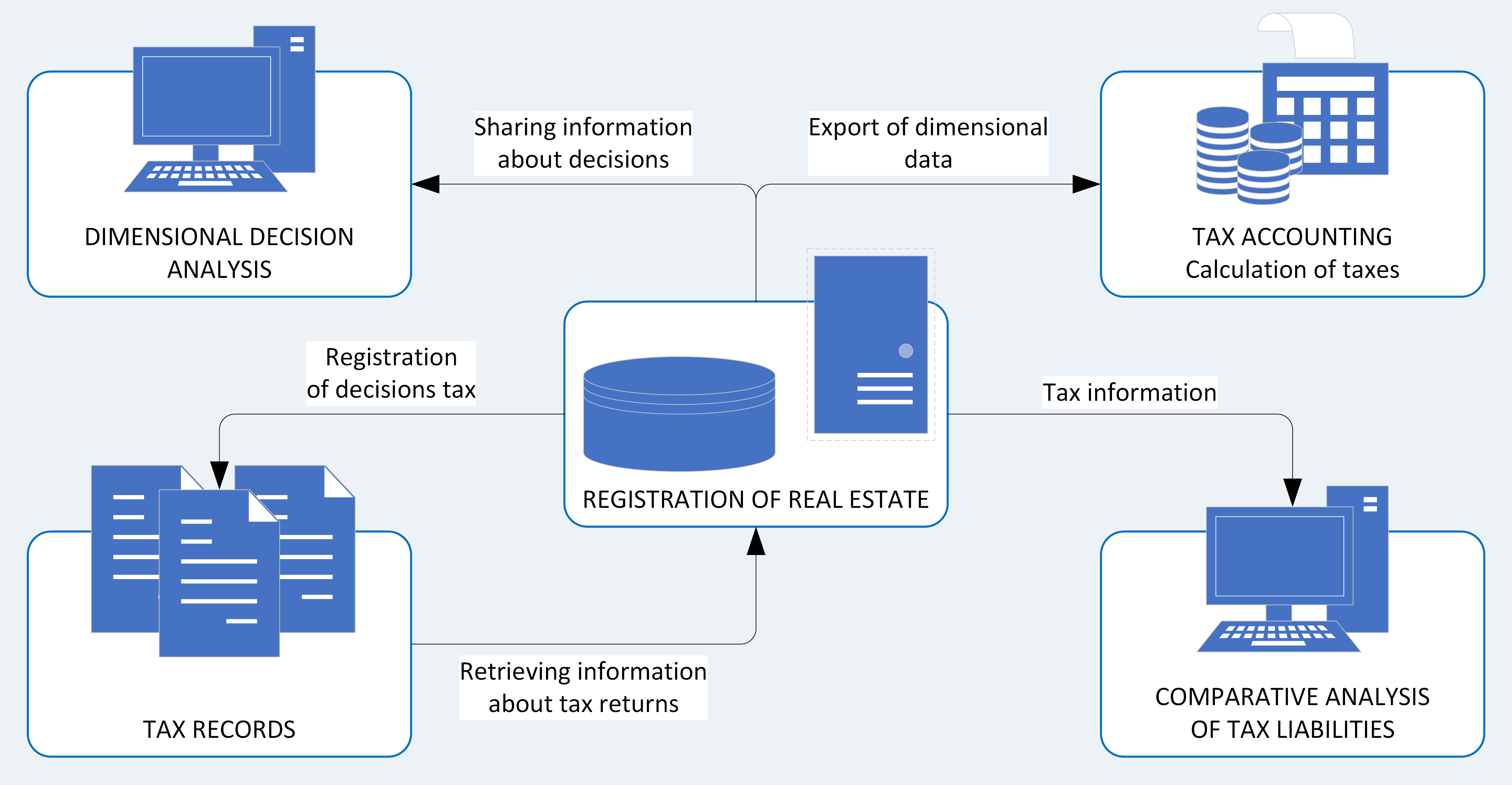

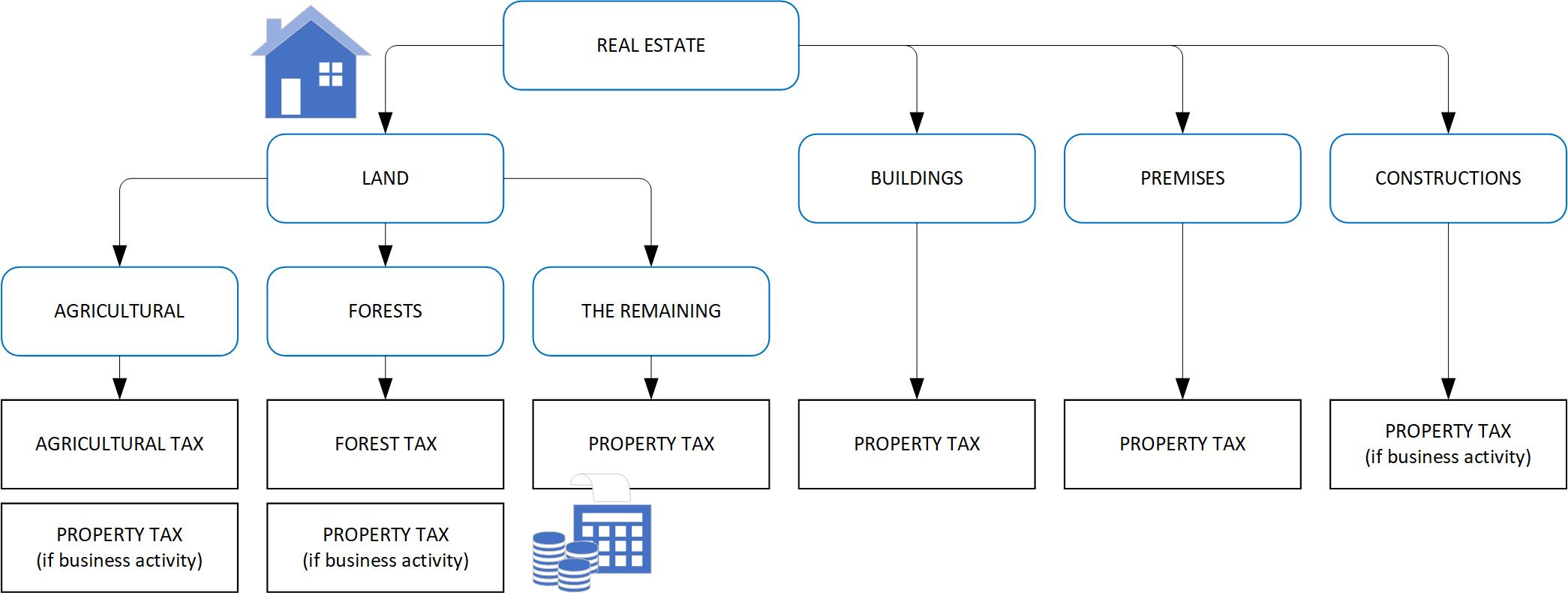

The computer system enabled free management of full information on the real estate tax as well as the agricultural and forestry taxes, calculated for natural and legal persons. The application was integrated with the electronic real estate register and the payables accounting module, ensuring automatic exchange of data related to receivables. It enabled the following functions:

- Creating and maintaining taxation units based on taxpayers’ data;

- Handling tax liabilities in accordance with applicable regulations;

- Calculation of dimensional and changing decisions and automatic booking of receivables;

- Checking real estate data;

- Creating summaries and reports necessary for inspections, reconciliations and statistics;

- Defining and calculating tax exemptions and reliefs;

- Retrospective tax calculation based on historical data on components and tax rates;

- Analyzing tax rates and creating revenue simulations;

- Creating and printing personalized tax decisions;

- Printing receipts with the possibility of automatic booking;

- Tax refund accounting.

The development of information technology in the City Hall also contributed to the use of electronic text editors in everyday work, such as ChiWriter (later replaced by MS Word) and Quatro Pro and Lotus 1-2-3 spreadsheets (subsequently replaced by MS Excel).