The unprecedented events of the last three years have shaken the world, posing serious new challenges to small, medium and large businesses. On the one hand, the suspension of economic processes resulted in losses and bankruptcies, and on the other hand, it accelerated the development of e-commerce and related industries. The negative phenomena caused by the pandemic regulations triggered decisions to radically transform the forms of international economic cooperation and to reorganize global business. The unipolar paradigm of development of the world economy, based on the hegemony of the US dollar, is giving way to a multipolar model that prefers dispersed economic centers and settlements in local currencies. This, in turn, translates into the directions and scale of foreign direct investments and changes to existing corporate and business strategies.

Economic shock

Today, Europe, and in particular the region of Central and Eastern Europe, is facing the serious effects of pandemic restrictions[1] and the threats brought by Ukraine’s war with Russia. It is experiencing an economic slowdown caused by a fall in demand in many industries, an increase in energy prices, disruption of supply chains and high inflation caused by an excessive supply of money.[2] Europe is suffering from at least three crises – financial, energy and demographic. Crisis phenomena weaken business, and also cause a decline in the investment attractiveness of the old continent – especially the countries neighboring Ukraine. The war also means the loss of many trade and investment opportunities in relations with Russia, Belarus and Ukraine[3]. The embargoes imposed on these countries mean the loss of large sales markets, which until recently were the basis for the existence of many Polish companies. The political decisions of the Polish government also raise serious concerns about the condition of the state’s finances,[4] which in the near future may not bear the burden of pension obligations and many other social programs offered at the expense of growing fiscalism, excessive state debt and deliberately sustained inflation.

The timing of the end of the war and the conditions under which it will occur are difficult to predict. Many Polish companies are losing their position on the domestic market, and Western Europe is becoming less and less accessible to them. Western European countries pursue a protectionist policy, effectively circumventing the European law on the single European market.[5] France, Spain and Italy are the most inaccessible countries. This situation raises serious concerns about the practice of enforcing the EU Community legislation. The answer to the crisis should be the elimination of barriers between the economies of individual Member States, not veiled protectionism. Ending the war and restoring the balance of the European common market is of fundamental importance for the stabilization of Europe, and in particular for the economic leaders of its center – Poland, the Czech Republic and Hungary. The distribution policy of the Polish government, which corresponds to the conservative attitude of the National Bank of Poland, should also undergo a radical change.[6] The Monetary Policy Council clearly does not follow the good example of the European Central Bank[7] and does not pursue the statutory inflation target with such determination as a quarter of a century ago with a similar level of inflation.

On the global economic scene, relations focused around the US dollar are changing. Against the backdrop of tough competition between the United States, China and Russia, BRICS-affiliated countries are gaining in importance[8]. The global economic model based on American dominance is giving way to regional agreements and new business processes. The reorganization of global value chains and supply chains is proceeding at an accelerating pace[9]. Local economic and political ties are strengthening. The sources of supply and trade intermediaries are connecting closer to major production centers and outlets. Deconcentration is a response to global consolidations and monopolies generating more and more threats on many levels of the world’s functioning. Economic regionalization is one of the key trends affecting the directions, forms and scope of the foreign direct investments (FDI). Investment decisions are long-term decisions that must consider the most probable scenarios of changes in social, economic and political reality.

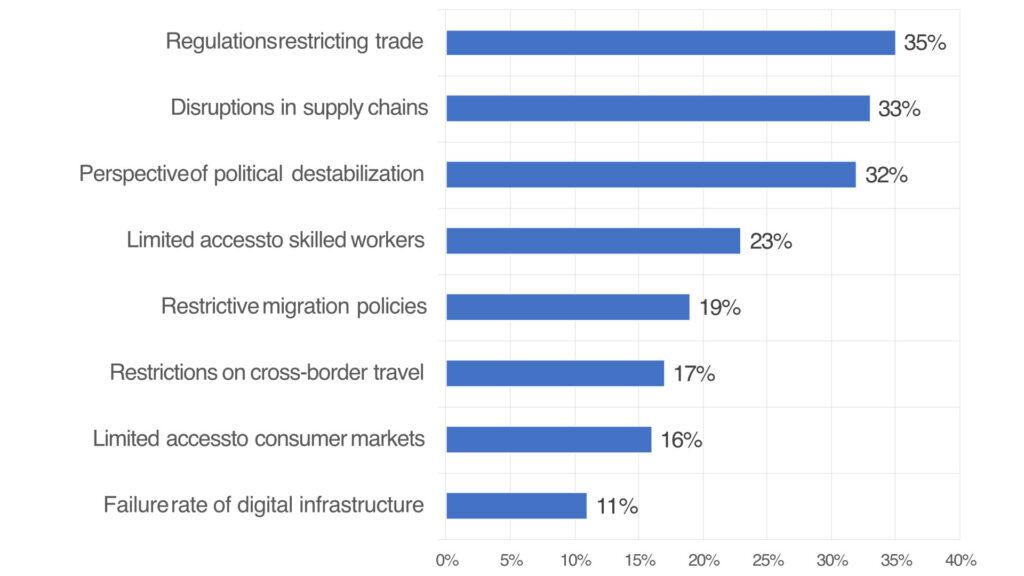

Factors influencing the process of deglobalization in the opinion of foreign investors

The slowdown of globalization – the so-called Slowbalisation[10] – has slowed down the pace of locating investments in many regions of the world, forcing enterprises to revise their current operating models. Concerns about the return of the pandemic[11]and interest rate increases in central banks have an additional negative impact on international mergers and acquisitions. On the other hand, the digital transformation of enterprises and their robotization and automation are accelerating.

Due to the protection of their interests, more and more countries use the aforementioned formal[12] and informal[13] protectionist procedures, which hinder the activity of foreign investors. New phenomena appear in international economic practice, such as securing supply chains, monitoring foreign direct investments, implementing Artificial Intelligence and building crisis-resistant organizational structures according to ESG principles[14].

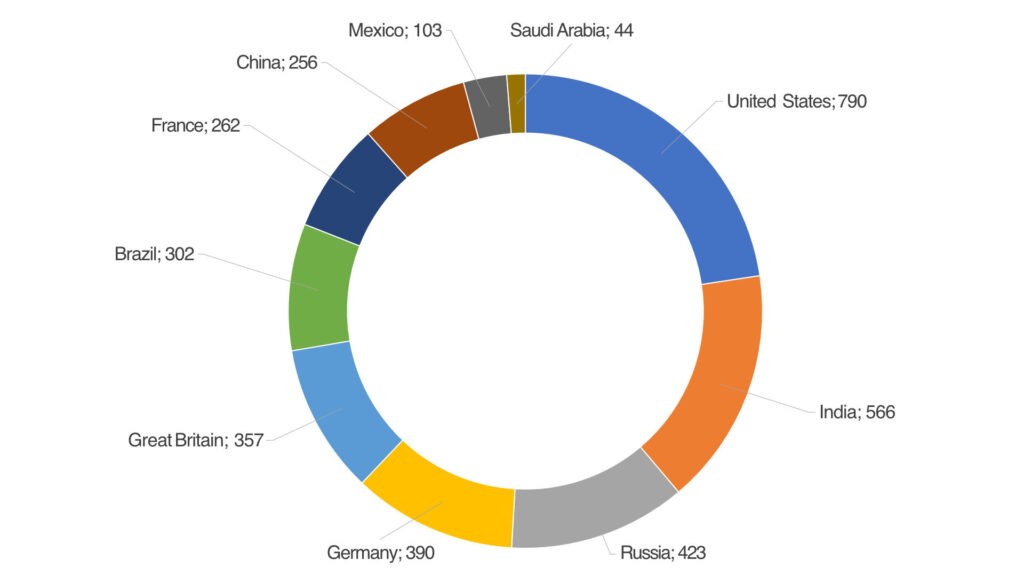

Number of protectionist regulations introduced by selected countries

in 2008-2019 (tariffs, concessions, etc.)

Development and survival strategies

The basic strategies aimed at the development and survival of the company are the diversification of its activities and expansion into new markets. They are implemented most often in the form of exports, foreign direct investment or foreign mergers and acquisitions.

In economically developed countries, the strategies of business diversification and market expansion belong to the set of classic methods of competitive rivalry. An example of the diversification of activities can be the Japanese concern Yamaha, which manufactures its products in such different business centers as electronics, automotive and musical instruments. An example of an effective expansion strategy into new markets can be the German corporation T-Mobile, which offers the same telecommunications services on geographically dispersed markets in many parts of the world. In both cases, the risk of bankruptcy, as a result of a downturn in a specific industry or on a specific market, is minimized. Losses in one segment of activity are compensated by profits generated in other segments. Similar benefits on a global scale are provided by the demonopolization and regionalization of economic centers.

Twenty the most active foreign investors in 2022

The economic expansion of Polish enterprises outside Poland is a relatively new phenomenon and limited mainly to Europe.[15] This is the story of less than three decades that have passed since the unveiling of the Iron Curtain and Poland’s accession to the European Union. We had to learn proper management methods practically from scratch, largely using the models provided by foreign companies investing in Poland.[16] Polish enterprises are better prepared to join the international competition, although many companies, especially small and medium-sized ones, are still unable to do so.

Foreign expansion is not, of course, and should not be a necessity for the most Polish enterprises. The best quality goods and financial profits should stay in the country, and the state should take care of the best conditions for business. A strong economy means jobs and a source of real values that determine the quality of life and the strength of the state. Foreign expansion should only be an option – a way to strengthen and develop domestic enterprises. However, it cannot be their only chance for survival – an escape to where a safe business is possible.

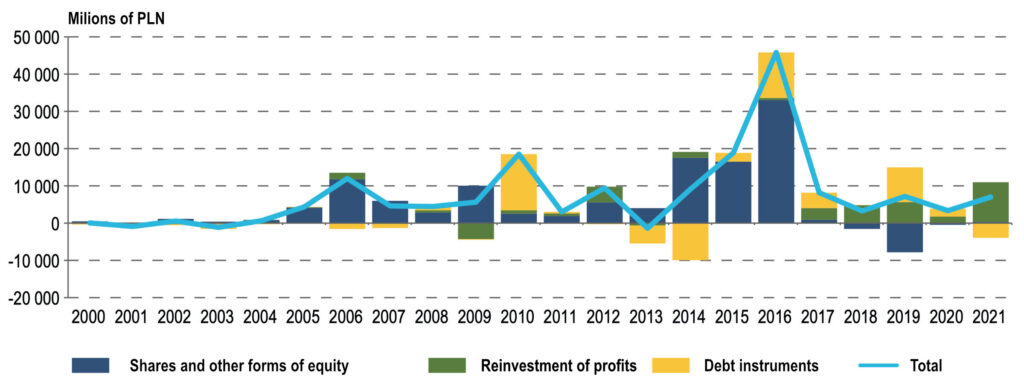

Value of transactions related to Polish foreign direct investments in 2000-2021

In uncertain times, many companies adopt a conservative and wait-and-see attitude. Simultaneous market, production, financial and political threats induce them to care more about their own status quo than to make bold investment decisions. This is a natural reaction, but it does not always bring the best results. Bold changes can be a unique opportunity for development and gaining a competitive advantage – an opportunity that cannot be overlooked. Companies investing abroad point to the following benefits:

- entering new markets = economies of scale and increasing sales;

- production diversification = business stabilization;

- securing supply chains = eliminating supply disruptions;

- reduction of operating costs = lower fixed and variable costs;

- transfer of technology and good practices = higher organizational culture and lower costs;

- reduction of locally existing risks = safety, energy, qualifications, licenses, etc.

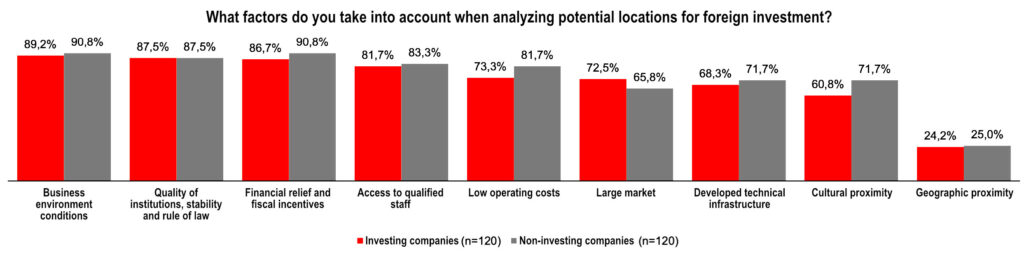

Factors influencing decisions on foreign expansion

The 90% of Polish entrepreneurs indicate the conditions for doing business as the most important factor influencing their potential decisions to locate their business abroad. They consider good conditions to be primarily friendly legal and tax regulations, and the quality of functioning of public administration and business environment institutions. They also value security, as well as financial relief and fiscal incentives. Many Polish companies declare great interest in expanding into foreign markets, but only a few of them undertake specific actions in this direction. Most of them do not plan to expand abroad in the next three years.

Companies that are already present abroad plan their operations differently. About 60% of them are considering further expansion. Nearly 46% plan direct investments, and about 14% plan mergers or acquisitions. These companies are aware of the benefits of being present outside Poland and Europe. They appreciate the daily contact with foreign partners, the experience gained in culturally different environments and the opportunity to raise the standards of their activities. They also point to the negative aspects of running a foreign business, such as difficulties in finding the right employees, higher costs of organizing core business, the need to learn from one’s own mistakes, and the risk of complete failure.[17]

What to invest in?

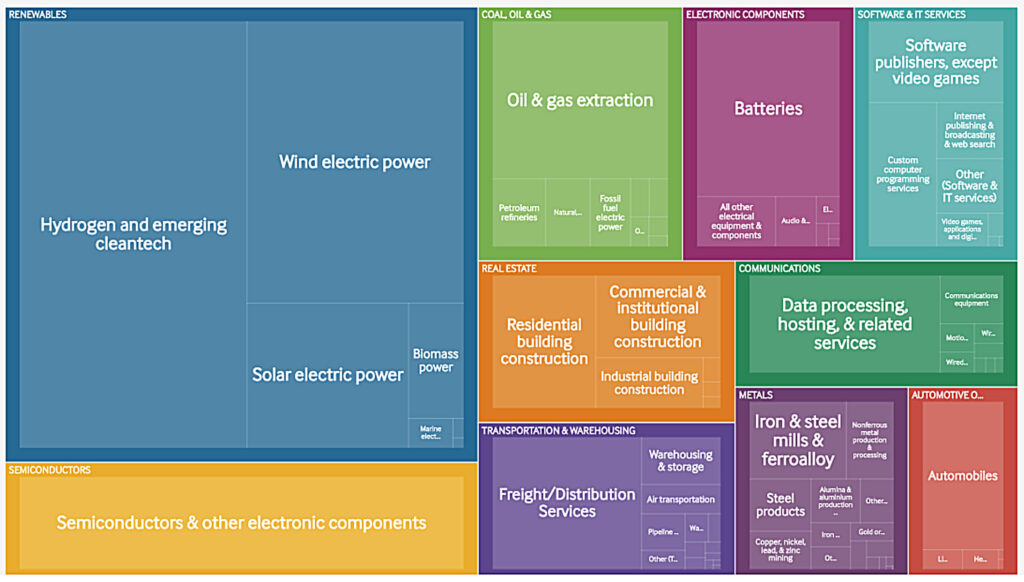

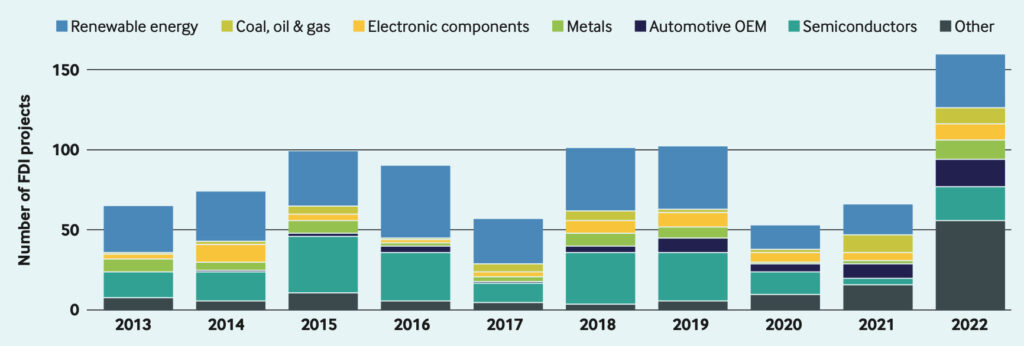

The main determinants of the functioning of the modern world are science and technology. This direction of development is reflected in the STEM (or STEAM) educational model[18], referring to the synthesis of science, technology, engineering, mathematics and art. In practice, it takes the form of digitization of work processes, automation and e-commerce, as well as the need to increase spending on research and development. These trends are also reflected in new business ventures. In 2020, STEM investment projects accounted for one-third of the value of all foreign investments. The largest part of them were investments related to the sectors of renewable energy sources, ICT, biotechnology and medicine.[19]

Sectoral structure in terms of the value of foreign investments in the world in 2022

Artificial Intelligence, cloud solutions, machine learning and privacy protection systems are increasingly used in many fields. Local IT structures are transformed into extensive network solutions, enabling, among others, distance learning, remote work, mobile banking and many other similar services. An important feature of digitization is also the desire of strong global economies to be as self-sufficient as possible. For example, the European Union and the United States intend to achieve independence in the production of microprocessors in order to free themselves from manufacturers from the Far East in this regard. Saudi Arabia, on the other hand, plans to build its own Silicon Valley and achieve full energy self-sufficiency from renewable sources for its ultra-modern cities.

Number of foreign investment projects worth at least USD 1 billion, by sector in 2013-2022

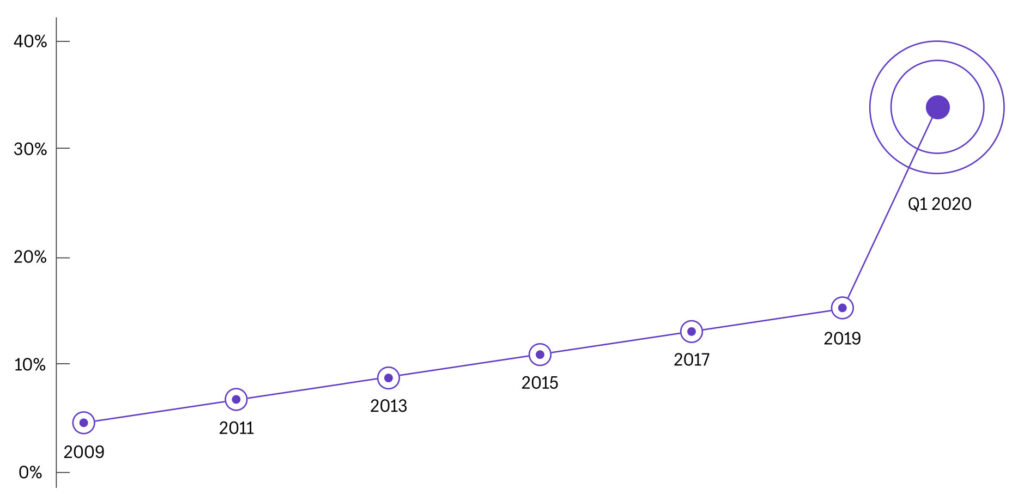

The development of electronic commerce has a powerful impact on contemporary and future economic processes. Revolutionary changes in this field are driven by such online giants as Alibaba, Amazon, BestBuy, eBuy, Etsy, Flipkart, HomeShop18 or Walmart. They are favored by the introduction of new forms of payment and the dissemination of electronic communication. Their incredible acceleration is the result of consumer isolation, which occurred as a result of the severe pandemic restrictions. Surprised by this unprecedented situation, consumers (private and institutional) quickly learned to shop online, rapidly increasing the turnover of online stores as well as logistics and courier companies. Online stores were followed by the world’s largest retailers, developing their online offer, and automating order fulfillment and customer service.

10 years of growth in 3 months. Trade penetration by eCommerce in the US in 2009-2020

The main advantages driving the development of e-commerce are:

- direct delivery of goods to the doorstep;

- lower prices than in stationary stores;

- convenient shopping anytime and anywhere, and

- the ability to place orders around the clock.

Customers of online stores also point to:

- a larger selection of products than in a brick-and-mortar store;

- richer information about products;

- the ability to compare products from different suppliers;

- significant price differentiation for the same product;

- uninterrupted process of placing and fulfilling orders, and

- the possibility of returning the purchased goods.

Online retail sales as a percentage of total trade turnover in 2020

Logistics and transport services are an integral part of e-Commerce. The rapid development of e-Commerce opens up new attractive investment spaces for them in all markets of the world. One of the important factors stimulating the development of these industries is the growing interest of consumers in goods purchased from outer markets – from neighboring and distant countries. An example is the Mark & Spencer brand, which, after the liquidation of its stationary stores in Poland, continues to sell clothing to Polish customers in an online store.

Where to invest?

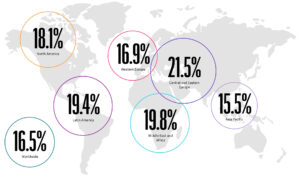

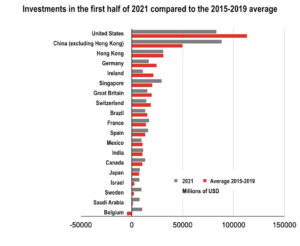

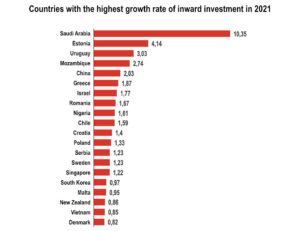

The years 2020-2022 are a period of economic breakthrough, one of the features of which is the reversal of the directions of locating foreign investments. Pandemic restrictions, regionalization of economic activities and protectionist behavior of the United States and the European Union have resulted in a reduction in foreign investment in the areas of these world’s largest economies. At the same time, it caused an increase in interest in peripheral economies. Saudi Arabia has attracted the greatest interest in the last two years. China, Singapore, Estonia, Uruguay, Mozambique, Greece, Israel and Romania also recorded a high increase in the value of foreign investments.

Changes in investment directions in 2015-2021

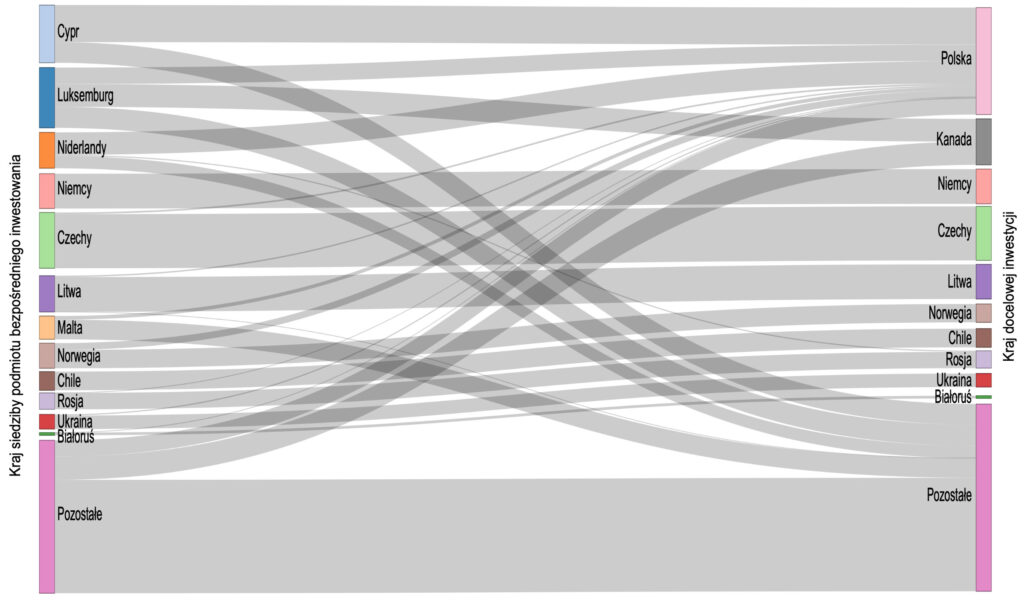

The greatest increase in the value of Polish foreign investments was recorded in 2021 by Great Britain. Poles also increased their investments in Croatia, Lithuania, the Czech Republic and in distant India, the United States, Brazil and Chile.[20] The largest amount of Polish investment capital was invested in Cyprus, Luxembourg, the Czech Republic and the Netherlands. However, this does not mean the actual level of economic involvement in these countries, but only foreign financial transfers carried out in order to optimize tax liabilities.

Polish foreign investment capital located in tax havens and its flows in 2021

Disinvestments, i.e. a reduction in the level of foreign investment, were recorded in Sweden. They concerned companies that did not conduct real business activity abroad, but were used to raise foreign investment capital.

Plans of potential foreign expansion of Polish enterprises cover mainly Europe. Most of the small and medium-sized companies consider investing in the countries that were part of the Comecon bloc[21]. Large enterprises with much greater potential invest in Western Europe, Central Asia and North America.

The most attractive countries for locating Polish foreign investments – basic ranking

| 1. India | 6. Latvia | 11. Lithuania | 16. Czech Republic |

| 2. Finland | 7. Slovenia | 12. Thailand | 17. Türkiye |

| 3. Estonia | 8. South Korea | 13. Hungary | 18. Australia |

| 4. Israel | 9. Denmark | 14. Malaysia | 19. Portugal |

| 5. Chile | 10. Romania | 15. Morocco | 20. Slovakia |

Source: PwC / PFR TFI Polish foreign investments – new trends and directions, 2022

Decisions on investment directions are based primarily on analyzes of the possibilities of gaining new customers (increasing sales) and reducing operating costs (supply, production, marketing, sales and service). They concern both their own industry and other industries available to investors in different geographic spaces. The ranking presented below includes those sectors of the economy that may be particularly attractive to Polish investors.

Sectoral ranking of the most attractive countries for investment in 2021

| Consumer goods | Production goods | Construction | Trade | ICT | |

| 1. | India | India | India | India | India |

| 2. | Finland | Finland | Israel | Finland | Finland |

| 3. | Israel | Israel | Croatia | Croatia | Israel |

| 4. | Denmark | South Korea | South Korea | Israel | South Korea |

| 5. | Türkiye | Denmark | Malaysia | South Korea | Denmark |

| 6. | Romania | Lithuania | Türkiye | Denmark | Romania |

| 7. | Lithuania | Türkiye | Hungary | Türkiye | Türkiye |

| 8. | Hungary | Hungary | The czech republic | Hungary | Hungary |

| 9. | The czech republic | Australia | Columbia | Australia | Australia |

| 10. | Slovakia | The czech republic | Australia | The czech republic | The czech republic |

Source: PwC / PFR TFI Polish foreign investments – new trends and directions, 2022

The promising Middle East

In addition to the standard rankings, there are poorly recognized and therefore particularly attractive investment directions. The obvious destination is a stable and law-abiding Finland, offering the best conditions for doing business in the world. What is not obvious is Saudi Arabia, which standing next to open to the world the United Arab Emirates, is growing into the economic leader of the Middle East.

The Kingdom of Saudi Arabia is the largest country in the region, with great economic potential, a clear vision of development, as well as efficient diplomacy and an investor-friendly administration. The rulers of this country are determined to make it a model for the whole world in terms of cutting-edge solutions in all areas of life. They want to make[22] the future of their kingdom independent of oil exports. They are intensively diversifying the Saudi economy and undertaking multi-billion investments in the latest technologies.

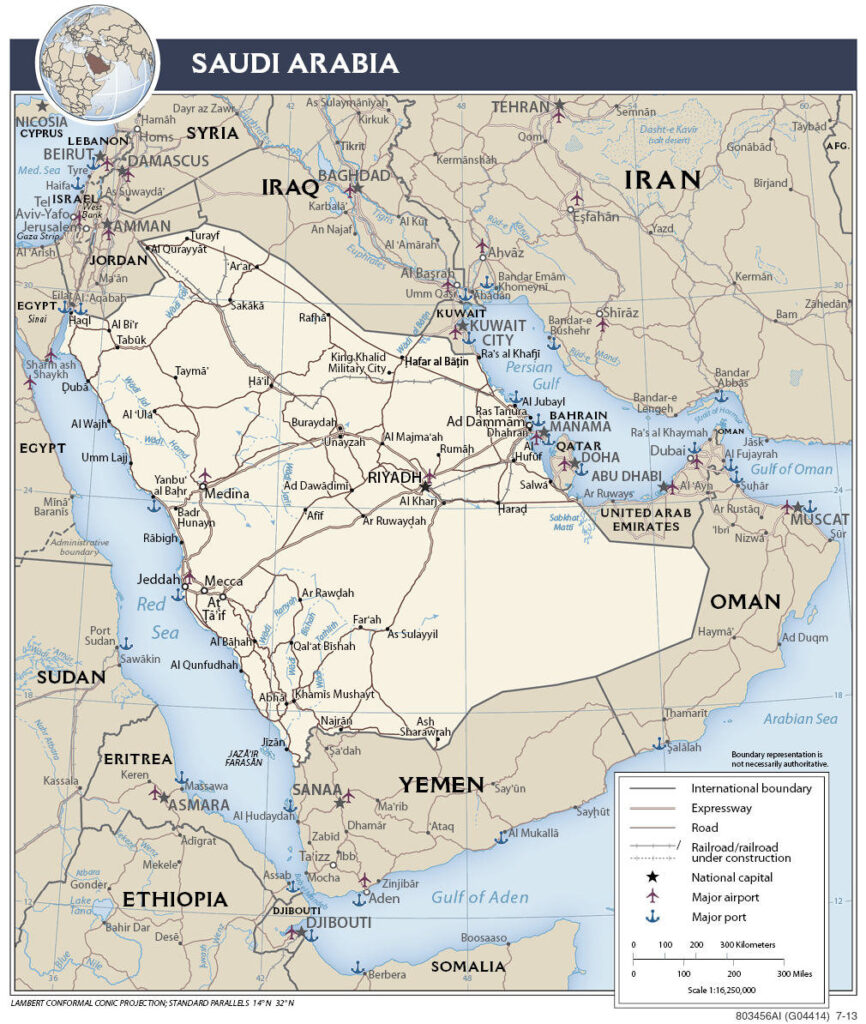

Borders and main communication routes of Saudi Arabia

The goals and directions of development are described in the government document “Saudi Arabia’s Vision 2030”, authorized by Prince Muhammad bin Salman[23]. According to this national strategy, thanks to the use of Artificial Intelligence and many innovative technologies, smart cities are to be created that meet the postulates of sustainable development set by the United Nations in its global strategy “Agenda for Sustainable Development 2030”.[24] Mecca, Riyadh, Jeddah, Al-Madina and Al- Ahsa are to be transformed into smart cities. In addition, there will be a new, ultra-modern mega-city (urbanized region) created, the construction of which has already begun under the futuristic program Neom.[25] The venture’s major development projects include: The Line – a linear apartment building; the Oxagon – floating industrial zone; Trojan – a ski resort in the desert; and the luxury island of Sindalah. The starting point for these bold plans is the assumption that life in smart cities will be safe, comfortable and happy.[26] However, there is no shortage of critics of such a strategic perspective, who consider it as an utopia.[27]

Regardless of the success of its strategic undertakings, Saudi Arabia will certainly remain an important economic partner of Poland. Its basic offer is to ensure energy security. On the Polish side, it can count on delivery of food and other goods.[28] The growing openness of the Saudi Arabian Kingdom to the world broadens the possibilities of establishing cooperation for many foreign partners. The competition is growing fast there, so… there is no time to waste.

The Neom’s four major investment projects: Trojan, The Line, Sindalah and Oxagon

Investing in Saudi Arabia is favored by the stabilization of the political situation in the Middle East. Of particular importance for the future of the countries of this region is the resumption of diplomatic relations between Saudi Arabia and Iran, which took place as a result of the agreement signed in Beijing on March 10, 2023. Its main goal is to reduce tensions in the Persian Gulf region and increase the security of economic transactions. The intermediate goal is to strengthen trade relations with China, and thus strengthen the Arab states in the international arena, and freeing out them from American domination.[29]

The Saudi Arabian authorities are taking decisive actions to gain confidence in their country, increase its accessibility and present wide opportunities for economic cooperation. The main advantages of this country are:

- strategic location connecting three continents;

- convenient location conditions for international logistic centers;

- growing population, urbanization and economic stability;

- leading role in the Middle East region;

- rapid development and large capital resources;

- absorptive market based on imports of most goods and services;

- striving to make the economy independent of oil exports;

- emphasis on economic diversification and modernity;

- good perception of Poland as an exporter and importer of crude oil;

- special support for construction, education and tourism;

- no protectionist barriers and an investor-friendly political climate;

- no restrictions on the transfer of capital, profits and dividends, and

- secure transaction monitoring by the Saudi Central Bank.

The value of imports from Poland is about 1% of the total value of Saudi imports. The goods imported from Poland so far are mainly:

- rail vehicles, rolling stock, equipment;

- electrical and electronic equipment;

- machines, boilers;

- dairy products, eggs, honey, food products;

- cereals, flour , starch, dairy products;

- furniture, prefabricated buildings;

- vehicles other than railway and tram vehicles;

- tools, utensils, cutlery of common metal;

- sugars and confectionery;

- perfumes, cosmetics, toiletries, and

- pharmaceutical products.

The most promising areas for establishing cooperation between Poland and Saudi Arabia are:

- agri-food sector (dairy, poultry, beef, vegetables, juices, frozen foods);

- chemical products (plastics, rubber, glass, ceramics, building materials);

- cosmetics and hygiene products (natural and organic products);

- medicines and medical equipment (equipping offices and hospitals, scientific equipment);

- wood and paper industry products (furniture, joinery, packaging);

- metallurgical industry (products of base metals and non-ferrous metals);

- energy and water management sector (design and construction) and

- defense industry (supplies of arms and ammunition as well as protective equipment).

A certain problem in Saudi Arabia may be the protection of intellectual property. This applies in particular to copyright in the pharmaceutical, cosmetics and IT industries. Many foreign branded goods are counterfeited there.

Poland, like other European Union countries, is perceived in the kingdom of Saud as a potential supplier of goods of comparable quality to Western European ones, but cheaper. Polish metallurgical products, construction materials, electrical and energy equipment, furniture, groceries, dairy products, vegetables, as well as services in the energy, shipbuilding, construction and ICT sectors have a competitive advantage there. It is worth remembering that pork, alcohol and publications contrary to the ethics and tradition of Islam are not allowed to be brought into Saudi Arabia.[30]

How to cooperate with foreign countries?

Economic cooperation with foreign countries may take various organizational and legal forms. The export of goods and services can be realized as a direct sale to a foreign buyer or a sale through a foreign intermediary who resells the imported goods on its local market. The sale of goods can also be carried out by a foreign agent searching for buyers or by its own representative office. Starting a business abroad may take the form of foreign direct investment (greenfield), or mergers (joint ventures), or acquisition of foreign companies (brownfields). Foreign expansion can also be done by licensing access to your own products or selling your franchise abroad.[31]

Trade intermediaries in international transactions are usually local foreign trade centers. Cooperation with them is convenient in the absence of any experience on foreign markets. The role of the foreign agent is then performed by a specialized local company that is well versed in the local market, legal, financial, organizational and cultural realities. It is most often an import-export agency (trading house) searching abroad for products or partners with the parameters indicated by the importer.

When cooperating with an agent, you should exercise caution, examining its effectiveness and credibility. A more advantageous and safe option, although requiring some expenditure, is an own foreign representative office. It allows you to safely reach higher revs in less time. A foreign representative may be a natural person legally employed abroad or a company registered in a foreign country. Another, but the most demanding and costly, option is to create your own foreign distribution network. It is profitable only when you can be sure of stable and long-term sales on the foreign market.

In joint ventures (mergers), the foreign partner usually brings knowledge of local realities, its contacts and enables access to the market. These are inherently complex and risky ventures, usually undertaken only when the possibility of starting your own independent business is very limited. The best option is to own an independent foreign company or take over foreign companies entirely.

Regardless of the organizational and legal form, foreign expansion plans should be carefully thought out, not only in financial terms. It is not enough to have a good product to be successful. The success of foreign expansion depends mainly on the knowledge of local realities. When planning foreign investments, you should analyze:

- adequacy of your offer to the specificity of the foreign market;

- brand recognition and trust;

- language, cultural and marketing barriers;

- legal conditions and restrictions;

- effective dispute resolution options;

- access to sources of supply (supply chains);

- access to suitably qualified employees, and

- opportunities to establish and use local contacts.[32]

When planning foreign expansion, you can take advantage of the information, advisory and financial assistance of many domestic and foreign institutions. Support on the Polish side is provided by, among others, institutions of the Polish Development Fund Group, such as Bank Gospodarstwa Krajowego, Polish Investment and Trade Agency, Export Credit Insurance Corporation, Polish Agency for Enterprise Development, Industrial Development Agency, Foreign Expansion Fund FIZ AN and PFR Towarzystwo Funduszy Inwestycyjnych S.A.

Tomasz Domański

Podkowa Leśna, 2023

© All rights reserved.

Copying without the author’s consent is prohibited.

Contact: kontakt@tomaszdomanski.eu

www.tomaszdomanski.eu

Footnotes

[1] Future Industry Platform “Changes caused by the COVID-19 pandemic in the SME sector and their impact on the implementation of business processes “, Warsaw, 2022

[2] Association of Employers and Entrepreneurs, “Inflation in Poland and in the world “, Warsaw, 2022

[3] Record of the meeting of the Committee on Agriculture and Rural Development of May 8, 2023 , Chancellery of the Sejm, 2023

[4] Parliamentary bill amending the Constitution of the Republic of Poland, print 2263 of April 7, 2022

[5] The research conducted with the participation of over 1,150 entrepreneurs from Poland, the Czech Republic and Slovakia showed that almost 40% of the surveyed companies encountered personally or through business partners the use of protectionist practices within the European Union. More: Association of Polish Employers, ” Protectionism within the European Union and how to counteract it “, Warsaw, 2020.

[6] Tomasz Grabia , ” Reactions of the National Bank of Poland to changes in inflation rates and economic growth during the COVID-19 pandemic “, Folia Oeconomica , Acta Universitatis Lodziensis , Lodz, 2022

[7] “The ECB’s interest rate hikes are already having an impact on bank lending conditions. We will continue to do so until inflation returns to its medium-term target of 2% soon. At the same time, we will carefully analyze how our policies affect the economy”, Christine Lagarde , Frankfurt am Main, June 1, 2023, source: European Central Bank

[8] BRICS – an economic agreement of Brazil, Russia, India, China and South Africa, aimed at creating a new monetary system, increasing the role of developing countries in world monetary institutions and reforming the UN. In February 2023, 13 countries declared their accession to the BRICS agreement, including Saudi Arabia and Iran. More : UN, BRICS Investment Report , New York , 2023; International Trade Center, “ BRICS Trade in. Services Report 2022 “, Geneva , 2022

[9] “Value chain” is a formula for delivering value to the customer, i.e. a product or service. Here – a model of cooperation of geographically dispersed enterprises, i.e. a business model with a global reach.

[10] “Slowbalisation” is a term coined by Adjiedj Bakas in 2015 and distributed by The Economist in 2019. Reference to him , among others Goldman Sachs in his Global Economic Paper : The Path to 2075 – Slower Global Growth, But Convergence Remains Intact , New York , 2022

[11] Much controversy surrounds the international agreement on pandemic prevention and preparedness, which calls for the establishment of a global bio -security architecture and the granting of unprecedented powers to the World Health Organization to limit civil rights and freedoms. Commentary on the latest version of the proposed regulations: Weronika Przebierała, ” Another version of the anti-pandemic treaty . More and more details ” , OrdoIuris.org, Warsaw, February 7, 2023

[12] In 2019, the European Union and the United States introduced regulations regarding the screening of foreign direct investments, the purpose of which is to protect particularly important sectors of the economy due to state security and unfair competition.

[13] Michał Kołtuniak, ” Hardening access to the market is an act of unfair competition “, Rzeczpospolita, Warsaw, 03/09/2013

[14] ESG – short for Environmental , Social , Governance , meaning a set of rules for building a sustainable, resilient and goal-oriented organization.

[15] About 84% of Polish foreign direct investments are located in Europe. source: NBP, ” Foreign direct investment in Poland and Polish direct investment abroad in 2021 ” , Warsaw, 2023

[16] The 1990s were a period of intensive expansion of foreign capital into Poland. The effects of this expansion are particularly visible in the retail sector (FMCG), still dominated by foreign investors. source: Aleksandra Grzesiuk, ” Experience of Polish commercial enterprises in expanding into foreign markets ” , Handel Wewtrzny No. 5 (376) of 2018, pp. 90-100, 2018

[17] PricewaterhouseCoopers , PFR TFI, ” Polish foreign investments: new trends and directions ” , Warsaw, 2022

[18] STEM is an acronym words : Science, Technology, Engineering, Mathematics; STEAM is STEM supplemented with the word Art .

[19] FDI Intelligence report 2020: www.fdiinsights.com/fdi/report2023

[20] PricewaterhouseCoopers , PFR TFI, ” Polish foreign investments: new trends and directions “, Warsaw, 2022

[21] Comecon – stands for The Council for Mutual Economic Assistance. An organization established in Moscow in 1949 to coordinate economic cooperation between the bloc of countries subordinated to the USSR. It existed until 1991 .

[22] “My first objective is for our country to be a pioneering and successful global model of excellence, on all fronts, and I will work with you to achieve that.” King Salman bin Abdulaziz Al Saud, Custodian two saints mosques , “Arabia Strategy 2030”, Riyadh , 2016

[23] National strategy; government document: ” Saudi Arabia’s Vision 2030 ”, Riyadh, 2016

[24] United Nations, ” 2030 Agenda for Sustainable Development “, New York, 2015

[25] NEOM is the most ambitious architectural project in the history of mankind. More: www.neom.com

[26] Maja Antonina Zastawnik-Perkosz, ” Smart city – benefits and threats “, Housing Environment. Architecture of the 21st Century No. 31/2020, Warsaw, 2020

[27] Damian Szymański, ” They are looking for a future beyond oil “, BusinessInsider.pl, March 30, 2021

[28] Kamil Turecki, “ Poland-Saudi Arabia is not only football. ‘Giant opportunity’ and risk , Onet.pl, November 26, 2022

[29] Sara Nowacka, ” Saudi Arabia’s policy in the light of the agreement with Iran “, Polish Institute of International Affairs, Warsaw, April 20, 2023

[30] Wielkopolska Development Fund, “Saudi Arabia. Desk research ”, Poznań, 2020

[31] Investin Sp. z o. o., ” Strategies of entering foreign markets “, Poznań, 2016